Major cities across India have been expanding spatially with increasing migrant workforce and paucity of land.

With passage of time, to cater to the growing demand from corporates, the CRE markets in these cities have also mushroomed along the fringes where these cities are expanding.

These Business Districts away from the city center towards outer boundary of city are known as Peripheral Business Districts (PBDs).

Demand for PBDs has been gaining upward traction, as options in CBD and SBD locations become scarce and costlier.

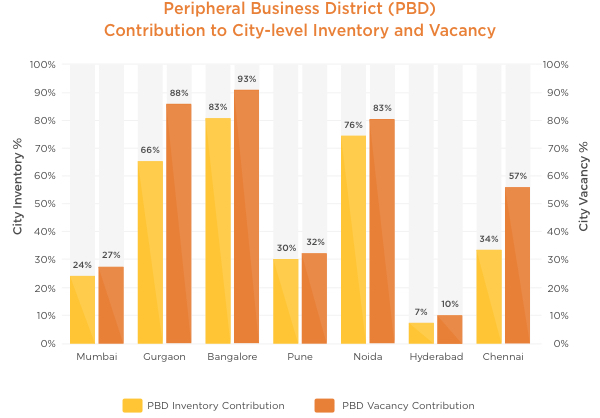

Propstack analysed the contribution of PBD markets to the total city inventory and vacant space across top 7 cities.

Bangalore has the highest inventory contribution from PBD location. With more than 80% inventory and greater than 90% of vacant area in PBD markets, it can be deduced that the CRE industry for this city is majorly concentrated and focused in PBD locations.

Noida and Gurgaon follow Bangalore in inventory contribution – with 76% and 66% of the Grade A buildings located in peripheral markets. For Noida, the vacancy contribution by these locations is still within suitable limits compared to inventory, but for Gurgaon the gap between vacancy and inventory contribution widens indicating that currently central locations are much preferred.

Chennai peripheral locations contribute more than 50% to the current vacant space in the city whilst the contribution to inventory is comparatively much lower. The gap between contribution to inventory and vacancy is highest amongst top 7 cities in Chennai, indicating the companies here are still taking time to move away from the city center.

PBD locations in Mumbai and Pune contribute to nearly 1/4th of the total inventory at city-level. Both cities have PBD markets with stable demand-supply equation as the difference between inventory and vacancy contribution is minimal.

Hyderabad PBD’s contribution to the overall CRE city level dynamics can be currently considered negligible with suburban locations driving the city growth. Hyderabad PBD locations will take some time to match-up to the demand in other cities.

*Q1 2017 Grade A data only

For more information and CRE Insights login to www.propstack.com