Ambit Capital released a thematic report on ‘Real estate Lending’ which uses Propstack Loans data to offer unique and differentiated insights for investors and industry professionals.

We have highlighted some of the insights derived from Propstack Loans data product.

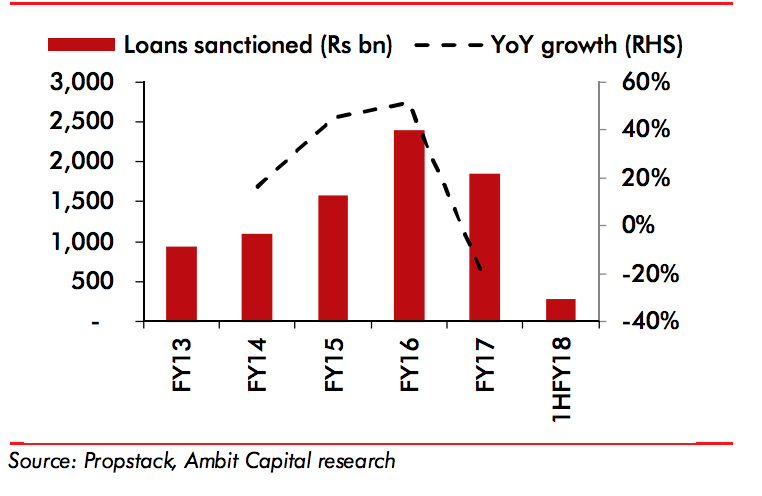

As per Propstack data, overall total outstanding sanctions of lenders to the sector are Rs 5.9 lac cr at Sept 17.

FY18 will have a sharp decline as real estate sector navigated through demonetization, GST and RERA.

Total loans sanctioned registered an 18% CAGR over FY14-17

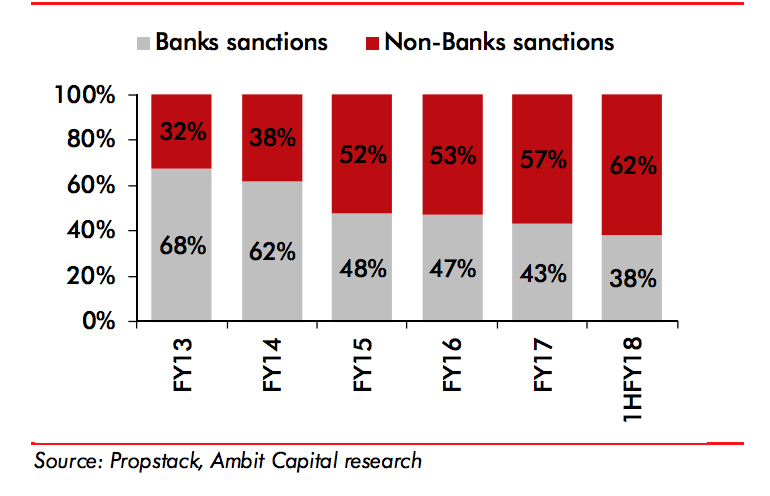

Sanction from non-banks (NBFCs/HFCs) has increased over the years

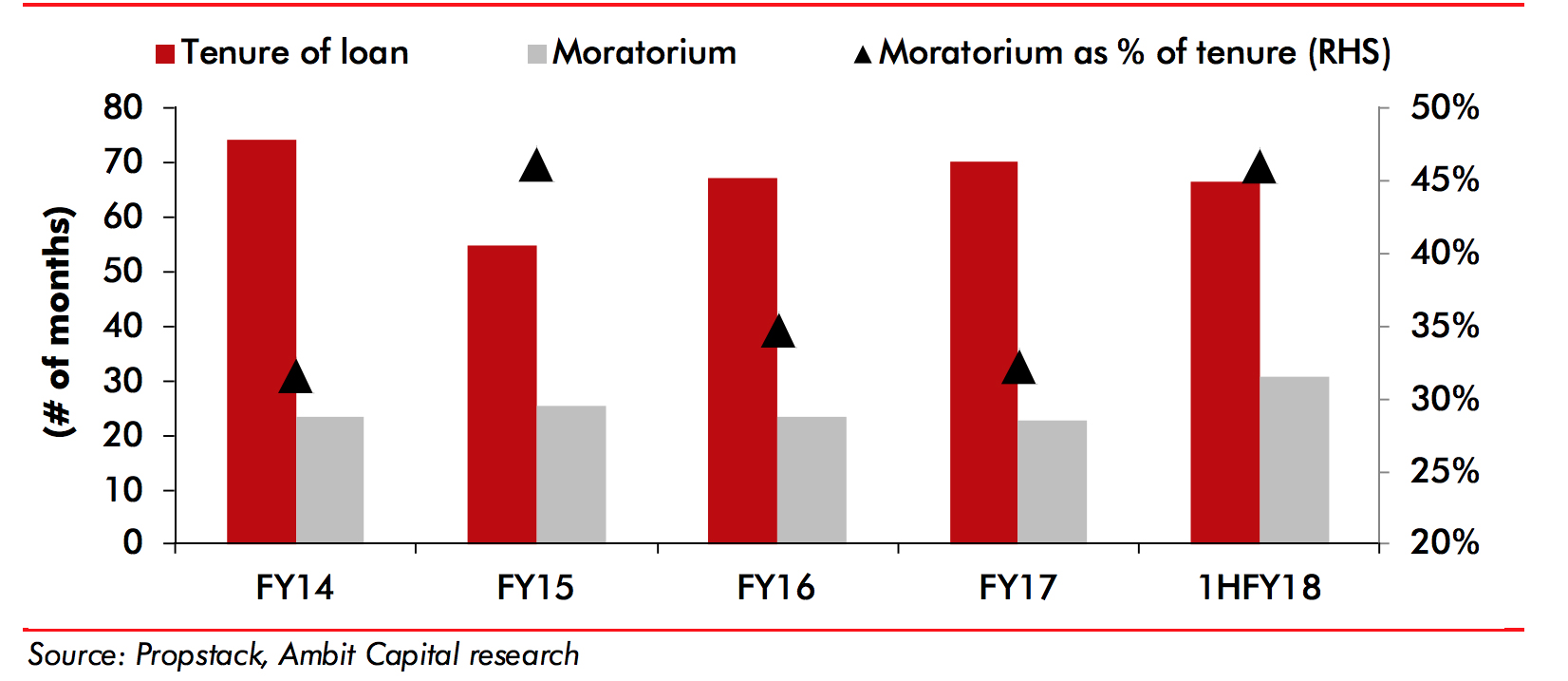

The data shows that average moratorium period has increased from average 23 months during FY14-17 to 31 months in 1HFY18

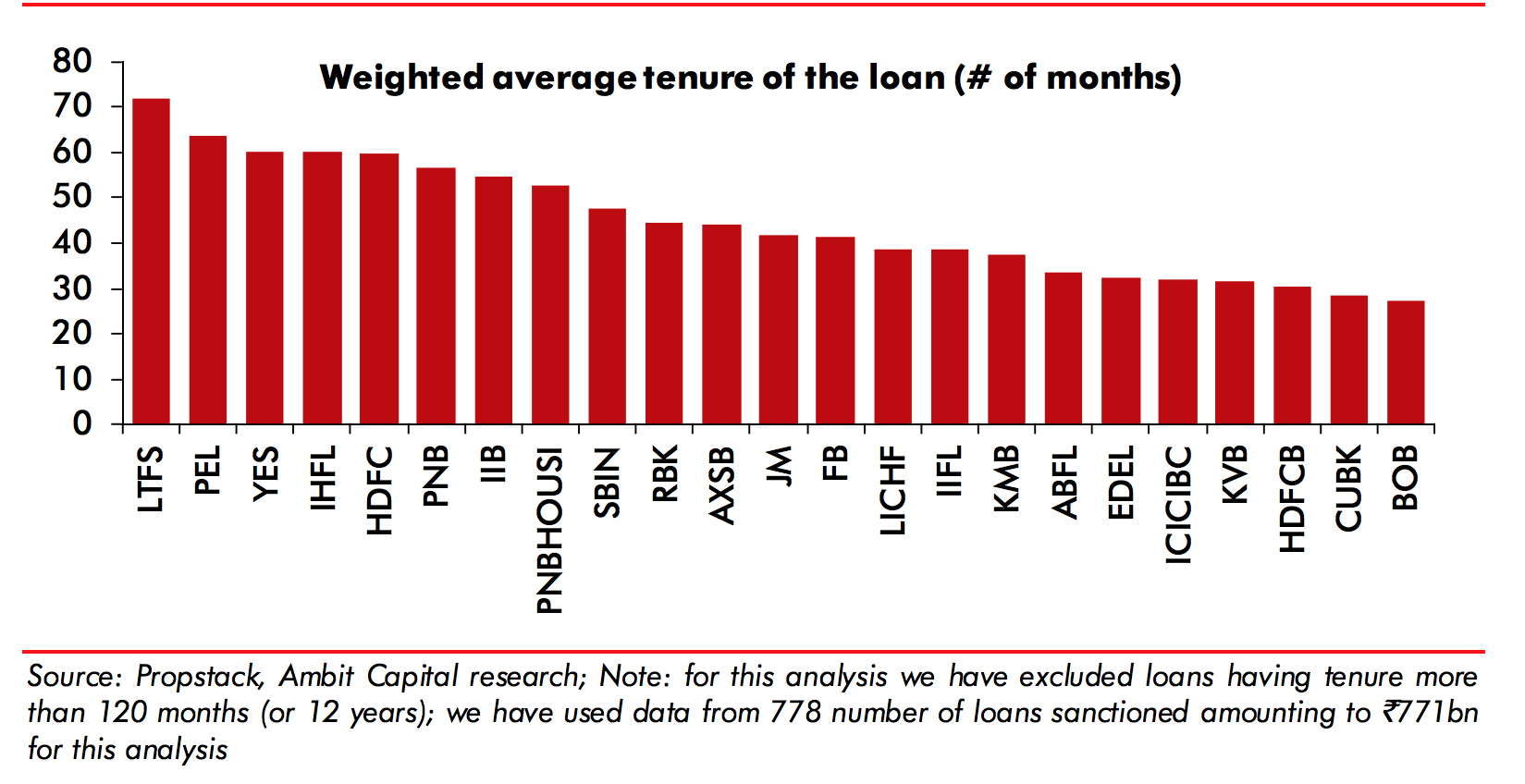

Average moratorium and average tenure of loans for the sector

*Lease rental discounting loans are generally long tenure loans by nature (and least risky loans) and hence not considered for calculation of weighted average tenure of loans.

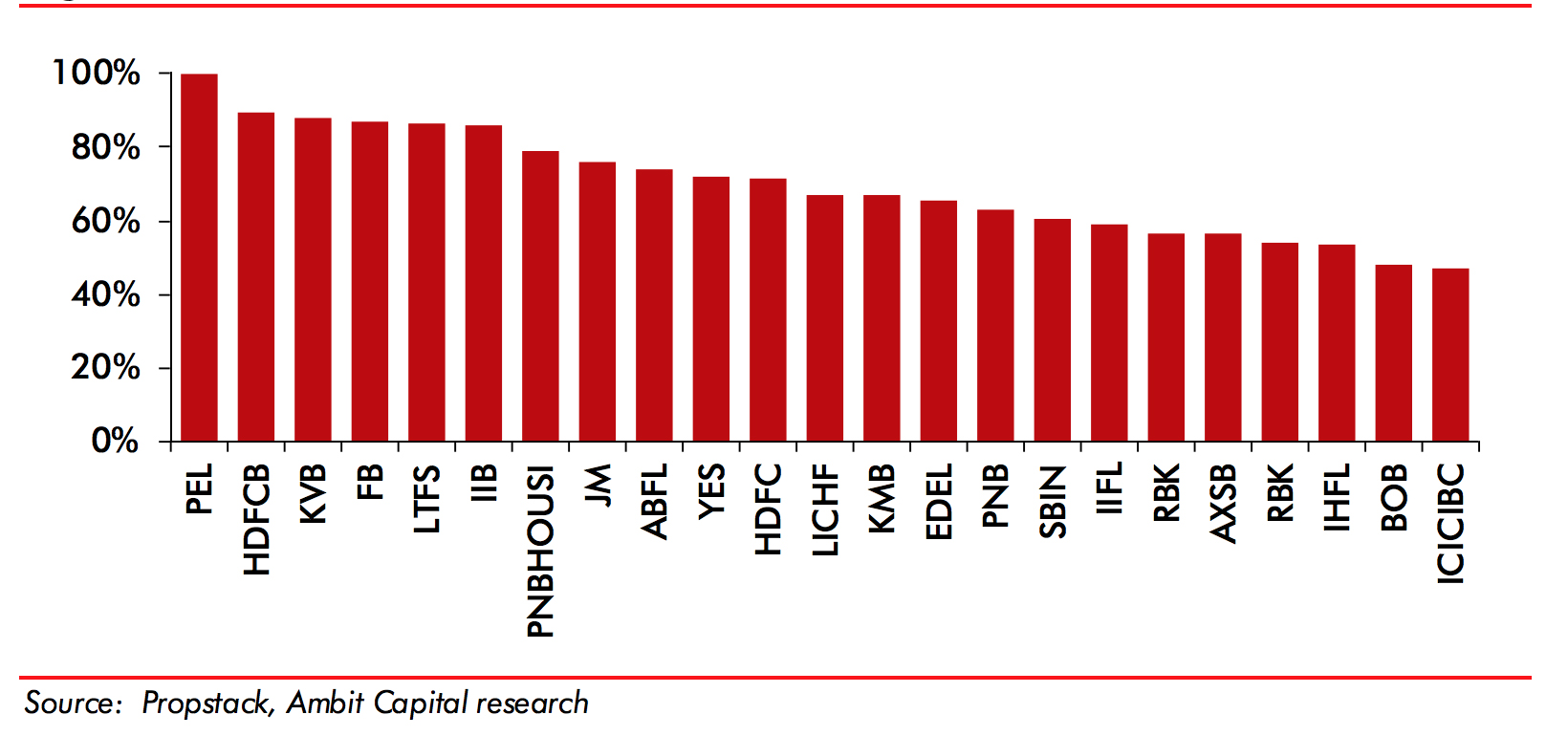

Largely unseasoned book. 56% of developer loans have been sanctioned over the last 30 months.

Loans sanctioned over FY16-1HFY18 as a percentage of total sanctions

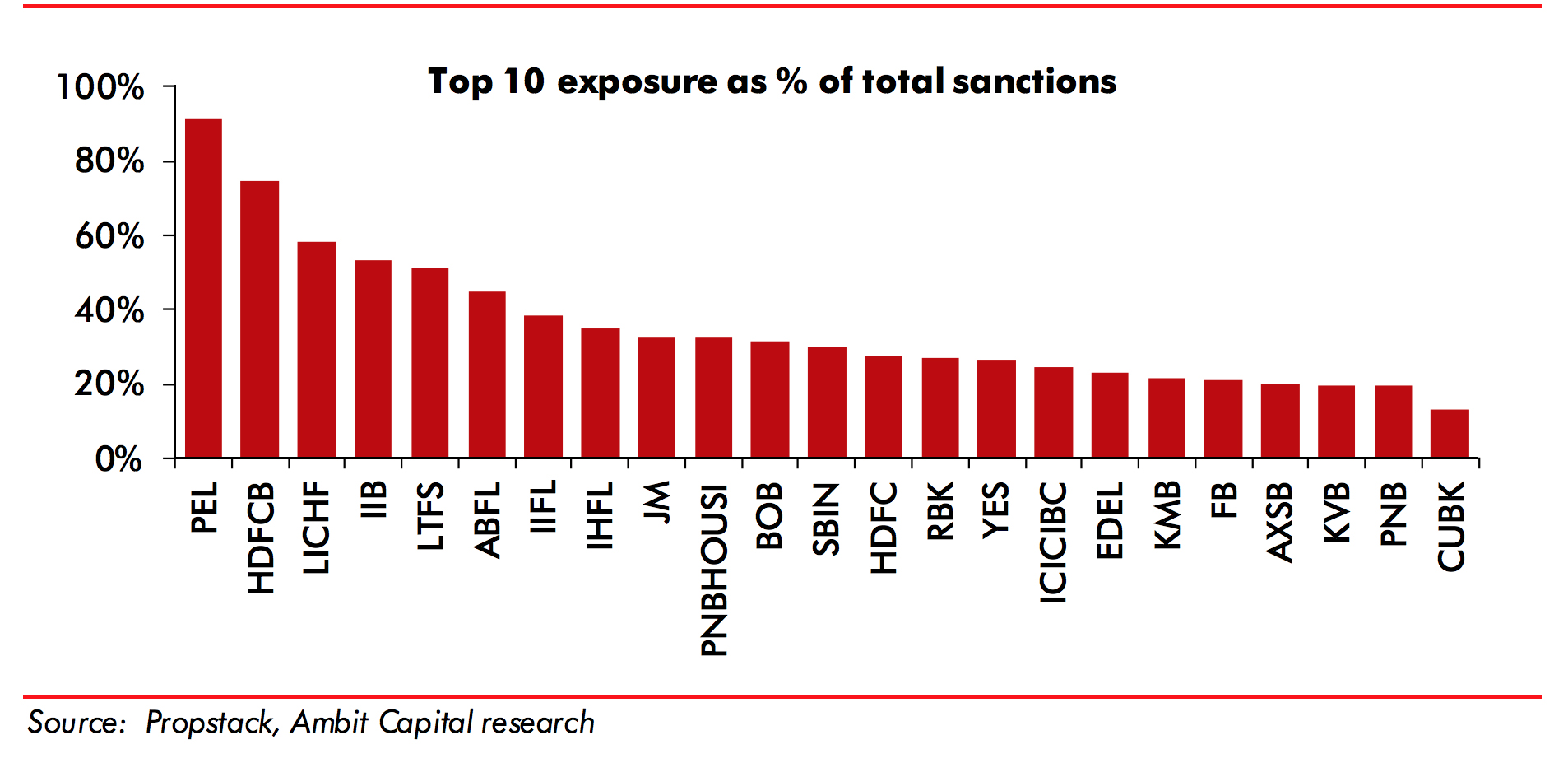

Top 10 exposure as % of total sanction shows a strategy to build concentrated portfolios by larger lenders

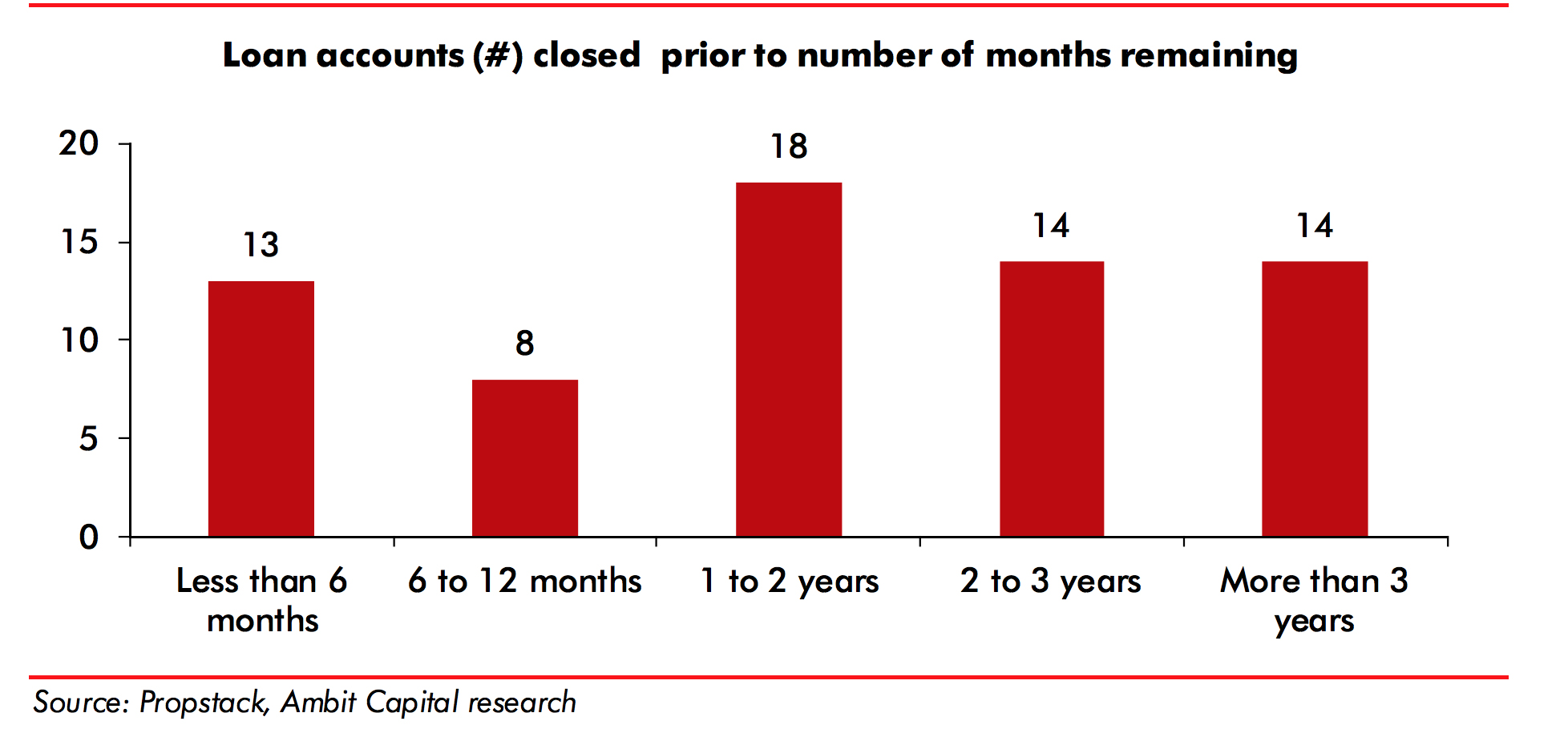

We analysed 67 loans of NBFCs which were sanctioned in the last 3 years (2014-16) and observe that though NBFCs had an average tenure of 41 months, the loans were closed withing 19 months.

Frequent refinancing is the nature of business